Disclaimer - Past Performance is NOT a Guarantee of Future Performance

Investing carries risk and uncertainty and investors can loose all of their money so should always seek professional advice before making any investment. This article is not investment advice and is provided for your education only.

2019 was quite a strong year with the close being less spectacular than one might have expected however. Particularly bad weather playing a part in the the end of year muted shopping spree on our high streets.

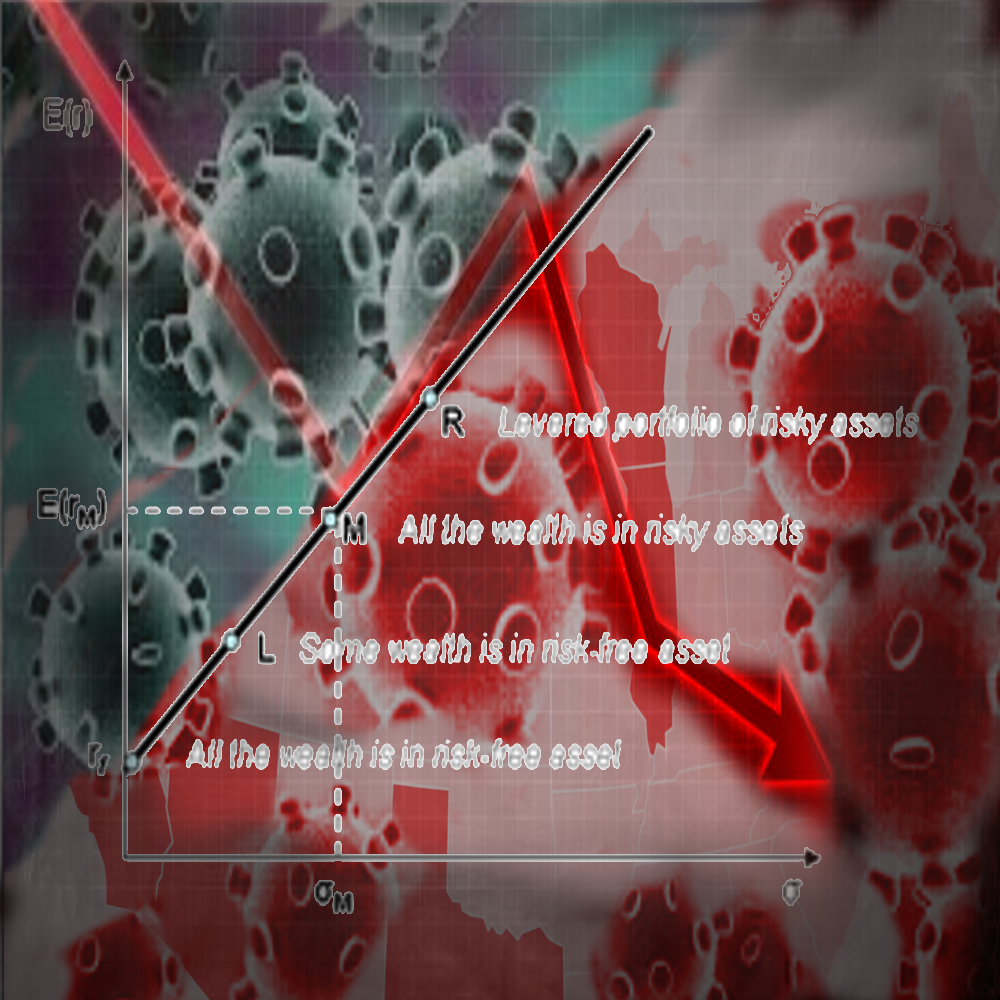

Corona-virus Alert

Of course nobody could have realistically forecast the Corona-virus which has het the markets in the early part of 2020 and its likely future impact, which will play out in the next few months as the economic data becomes available.

The estimates below do not factor in the underlying economic impact of the Corona-virus and so should be considered in the context of an Uncertainty which is now playing out globally. If the virus becomes a Pandemic, it is likely that Global Capital Markets will contract dipping the world into a deep recession, potentially putting an end to one the longest Bull Runs in recent investment history.

- 1. Global GDP estimated to rise in real terms to 3.4% a modest 0.3% increase on 2019.

- 2. Equities performance is likely to be supported by the decreased US - China Trade tensions and removal of uncertainty surrounding BREXIT in the UK and Europe.

- 3. The US should see a steady 2.3% growth on the back of improved consumer spending and a housing market recovery.

- 4. The risk of recession is just 20% not accounting for the Corona-visus uncertainties. Policy related shocks are also greater than in previous cycles.

- 5. Most developed markets Central Banks are likely to remain on hold through 2020 with Europe's slow growth expected to continue at 1.1%.